Below are some changes slated to hit the mortgage market in 2017. I received this from an awesome mortgage broker (contact details below if anyone is looking)... The mortgage environment has already seen a lot of movement in 2017, here is a quick debrief of the three big changes thus far.

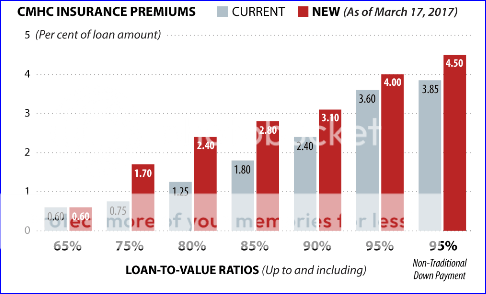

- Today CMHC announced they will be raising their premiums starting March 17, 2017. We are expecting the other insurers to follow.

- Rates with all lenders have increased and are increasing!

- BC’s New HOME Partnership Plan for 1st-Time Home Buyers is Live

CMHC Premium ChangesThe CMHC premium is a cost (as a percentage) on the loan to value of a mortgage, it is the cost to insure the mortgage over the life of the loan. As an example: A home that is $750,000 with a mortgage of $675,000 (90% LTV). Today’s premium would be $16,200 & the new premium starting March 17th would be $20,925 – a difference of $4,725 or about $20/month over the life of the loan. Here is an info graph that shows the premium changes.

Rising Rates It was the second week of November when we began to see rates really start to move, since then we have seen 5 year fixed rates move between 0.25% to 0.40% with most lenders.A product that was 2.34% is now at 2.59%, and similar products with the big banks are now at 2.84% or higher. Pre-approval is simple and easy, it does not commit you to anything but ensures you have today’s rate held for up to 120 days. If you are in the market to purchase, refinance, renew, or have a friend/family member who may be in one of these positions I would be glad to assist them. BC HOME Partnership Loan I have had a lot of referred clients calling in to ask questions about this program in the last few weeks, the questions have been great and so I decided to provide a FAQ list. I invite you to pass along this FAQ list and my contact info to friends & family in this space, as I would be glad to have a quick phone call or to sit down and discuss this plan with them further to ensure they have the best experience. BC HOME Partnership loan requirements:

Rising Rates It was the second week of November when we began to see rates really start to move, since then we have seen 5 year fixed rates move between 0.25% to 0.40% with most lenders.A product that was 2.34% is now at 2.59%, and similar products with the big banks are now at 2.84% or higher. Pre-approval is simple and easy, it does not commit you to anything but ensures you have today’s rate held for up to 120 days. If you are in the market to purchase, refinance, renew, or have a friend/family member who may be in one of these positions I would be glad to assist them. BC HOME Partnership Loan I have had a lot of referred clients calling in to ask questions about this program in the last few weeks, the questions have been great and so I decided to provide a FAQ list. I invite you to pass along this FAQ list and my contact info to friends & family in this space, as I would be glad to have a quick phone call or to sit down and discuss this plan with them further to ensure they have the best experience. BC HOME Partnership loan requirements: - Be a first-time homebuyer who has not owned an interest in a principal residence anywhere in the world at any time and has never received a first-time homebuyers' exemption or refund

- Be eligible for a high-ratio insured first mortgage for the home

- Purchase a home that is $750,000 or less.

- Be a Canadian citizen or permanent resident for the last five years

- Have lived in British Columbia for at least the full 12 months preceding your application

Other criteria are:

- The combined, gross household income of all individuals on the title must not exceed $150,000.

- The home being purchased must be used as the principal residence of all individuals on the title for the five years after purchasing.

Or click here to go to the BC Housing Website.

Sincerely,

Your Mortgage Pro,

Kerry Casidy

604.868.7081

kerry@casidy.ca